Forecasting Accuracy in Public Sector and Lessons Learned

There are more steps, more scrutiny, more signatures required in the Covid-19 World.

Challenges I’ve seen sales reps encounter:

Budget was not discussed upfront and the customer did not have the money. Once a quote was submitted after weeks of work by several people in multiple organizations the customer said “NO”. Many hours of time wasted on hope and “Hope” is not a strategy.

Responding to an RFP. Spending hours upon hours of time from many people in several organizations lighting a fire under people to move faster and the deal was lost. The deal was committed in the forecast as a solid win which makes the loss even more painful. Why would you commit an RFP deal if you didn’t write the RFP yourself positioning you as the winning vendor. You are cannon fodder, maybe trophy fodder but still fodder…

Working with IT and getting a “Yes” for a multi-year $1.1 Million dollar deal approved by the CIO only to have Procurement kill it. The customer’s IT team and Procurement team were not on the same page. IT believed the deal could be done and so did the departmental Purchasing team. State Procurement stated it was illegal under state law to finance future years. And, they could not pay upfront for future years. Also, the amount spent on year one could not exceed a percentage of the state contracts in place to try and get the most from year one and then provide lower amounts on future years referred to as option years. Procurement would not sign any language added to a quote or additional documentation which was challenging for the legal teams working on internal contract approvals for selling the products. Weeks of time were spent by several organizations trying to pull this deal in.

The CIO approved a 5 year deal and Procurement dragged out the purchase for almost a year. Procurement stated that steps were skipped and started the process over. Then people in the queue to sign were out and had other staff sign for them. Procurement kicked it back requiring the correct title to sign off. After all of this back and forth the budget was cut and the customer wanted a one year deal. A ton of time was burned from several organizations working to get this deal in.

Customer purchased a multi-year deal under the influence of an audit borrowing from future tax dollar funds. This is not the norm and not permitted under standard operating procedure. When the renewal came due, the intent was only renewing for one year. The rep forecasted a $700K multi-year renewal deal that ended up being one year $130K and four months late because they didn’t understand the purchase process and timeline of how long all of the approvals and bidding would take.

Another deal was forecasted as a commit because IT stated they wanted the products and would make a purchase. Again, it has CIO approval. Calling the CIO for an update would simply have the CIO call Procurement and reiterate the same message already received from Procurement. The CIO can’t make Procurement move any faster. Procurement stated it had to follow an official process because of the dollar amount and would take 2-4 months. Is it really a commit, yes for the future 4 months out but not for the current month or even the current quarter. Many things can go wrong in 4 months including budget cuts that could kill the deal. This should be forecasted in pipeline until a bid is closed and an awardee has been chosen. Then it could go to Best Case. Once a PO is in process, it could be updated to commit.

Lessons learned: Understand the Procurement process as well as and maybe even better than the Approval process. Know every step, every player and everything that could slow or kill the deal. Know the MANIACT, 5W’s, SWOTT, BATNA and maybe even what they had for lunch. I’m joking on the lunch but in all seriousness, ask questions and know the details every step along the way…

Utilize Disty, Resellers, IT and Procurement to map out the step by step process for Purchasing. Similar to building a nuclear submarine and sometimes just as complex, develop a SLED PERT Chart for yourself to guide you through the last steps and next steps of the timeline and acquisition. Confirm often with IT and Procurement that your belief of deal status is accurate.

Questions to ask:

How are they going to buy?

Will it go out to bid?

Can you purchase multiple years?

Can the customer pre-pay up front for multiple years in advance?

Another way to confirm, can the customer allocate funding beyond the current year?

Do you have a favorite reseller?

Does this need to be purchased through a SB, SBVE or MOSB reseller?

Is there a contract that this will be purchased from and is there a url for the details?

Can you finance? Can you sign agreements, contracts, do you add your own language or T’s & C’s or redline vendor agreements?

How long does this take?

What are the steps?

Is there a committee or does it need Board approval?

Who is the highest level signatory required?

What is the PO#? Can I get a draft copy?

Hyper-Qualify, Hyper-Qualify, Hyper-Qualify!

Jerry Lang

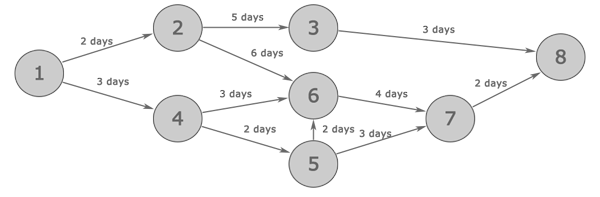

PERT CHART:

A PERT chart, based on the Project Evaluation Review Technique, is a project management tool used to visualize a project’s key milestones and overall timeline. PERT diagrams provide project managers with a realistic idea for how long each stage of their project will take to complete, including the estimated shortest, longest, and most probable timelines for each.